When you purchase a travel insurance plan, the coverage may be primary or secondary to any other insurance policy in the case of medical coverage. However, it’s easy to get confused as to which is primary vs. secondary coverage. This article will clear the air and help you understand why over 29 million Americans have multiple health insurances, including over half of all Americans over the age of 65, and explain the difference between a primary and secondary insurance plan as it applies to travel insurance.

Can you have two health insurance plans?

You can absolutely have two health insurance plans. When you purchase travel insurance, the health coverage component may either become primary or secondary to your domestic health insurance plan depending upon where you are and the details of the particular plan.

For example, if you were to purchase a travel insurance plan for a domestic trip, the health insurance would be secondary to the domestic health insurance that already covers you at home. However, if you were to purchase travel insurance for a trip overseas, outside of your domestic health insurance coverage area, the travel insurance plan would become your primary coverage abroad.

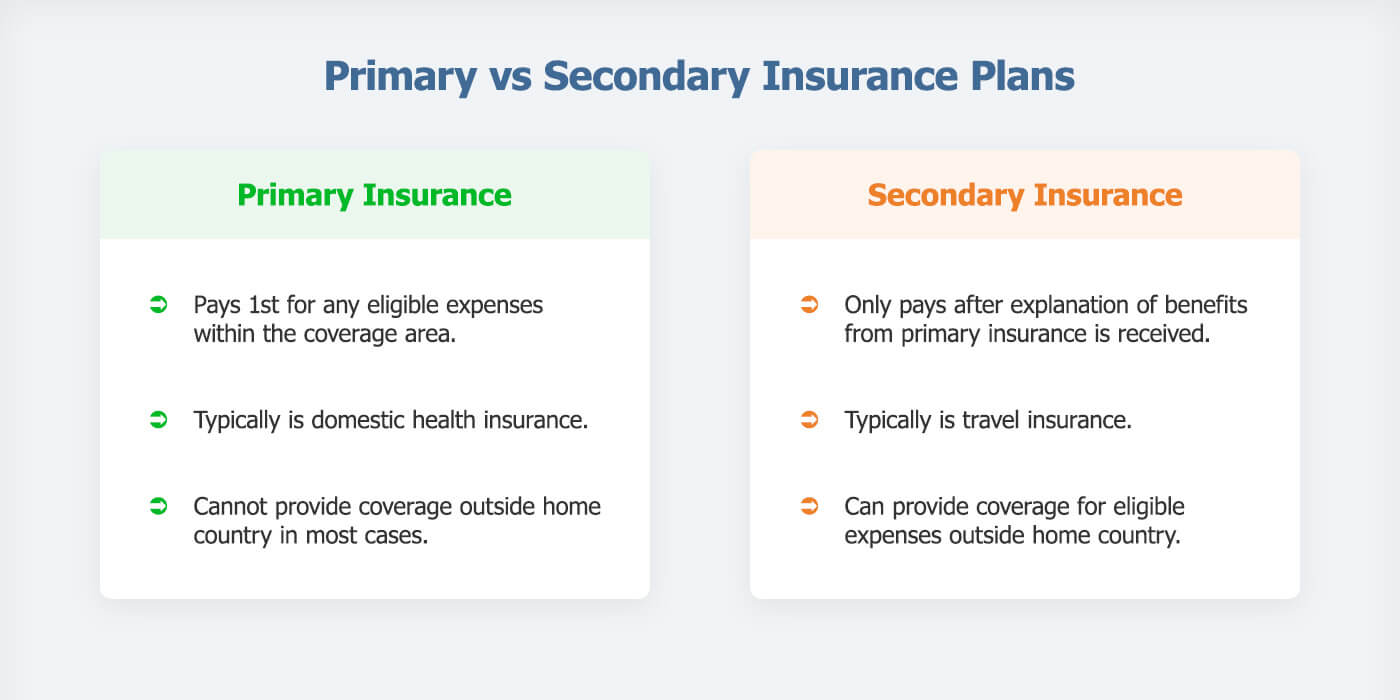

What is the difference between primary and secondary health insurance?

A primary health insurance plan will process your claims for payment as if no other health insurance plan exists. On the other hand, secondary insurance will only process your claim for payment after they receive an explanation of benefits showing how the primary insurance company processed the claim. The secondary insurance plan will cover the patient responsibility assessed by the primary insurance company for things like the copay, coinsurance, etc. In most cases, your domestic health insurance will be your primary health insurance in your home country, while your travel insurance will be secondary, with the travel insurance becoming primary when you’re abroad.

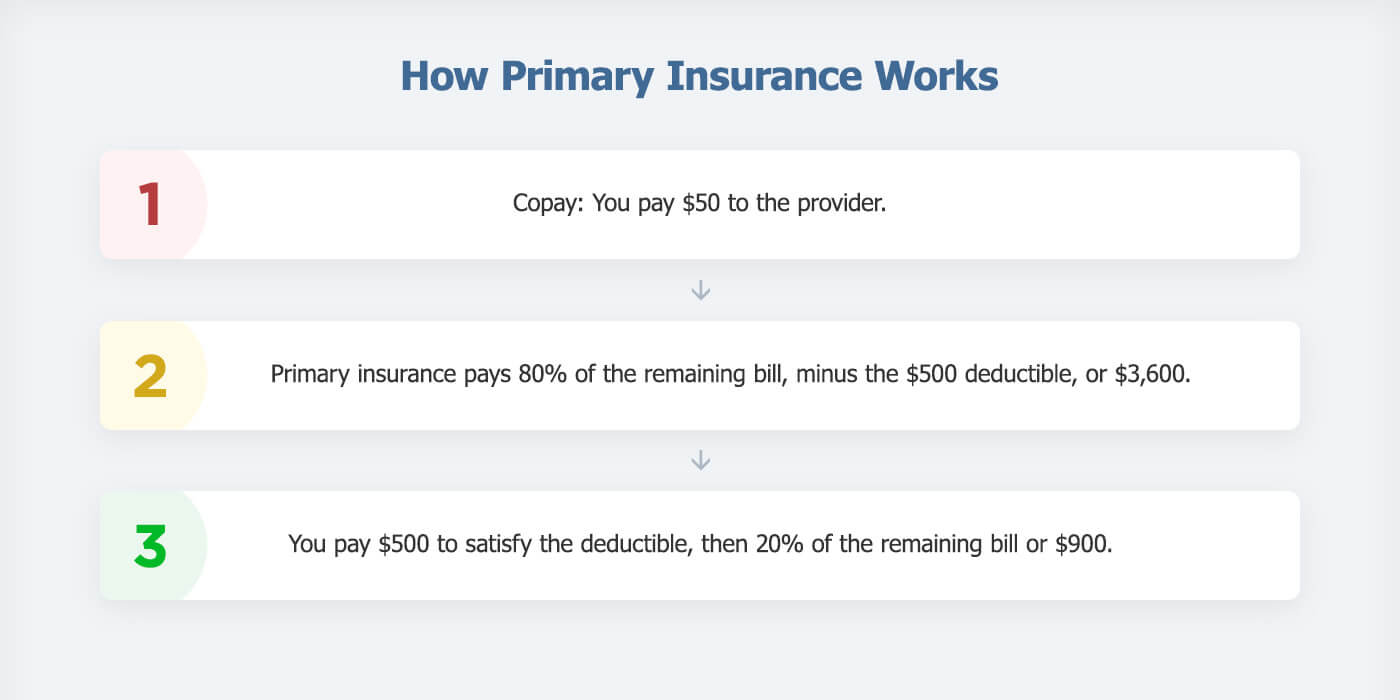

How Does Primary Insurance Work?

Most people in the US have their primary insurance through their employer, and both the employer and employee share the cost of a monthly premium for health insurance. When using the insurance, such as for a doctor’s visit, you would pay a fixed amount, called a copay, and then pay either your deductible or your coinsurance after the deductible has been met.

For example, let’s say you have a medical procedure that costs $5,000 and your health insurance has a $50 copay, $500 deductible and 80/20 coinsurance:

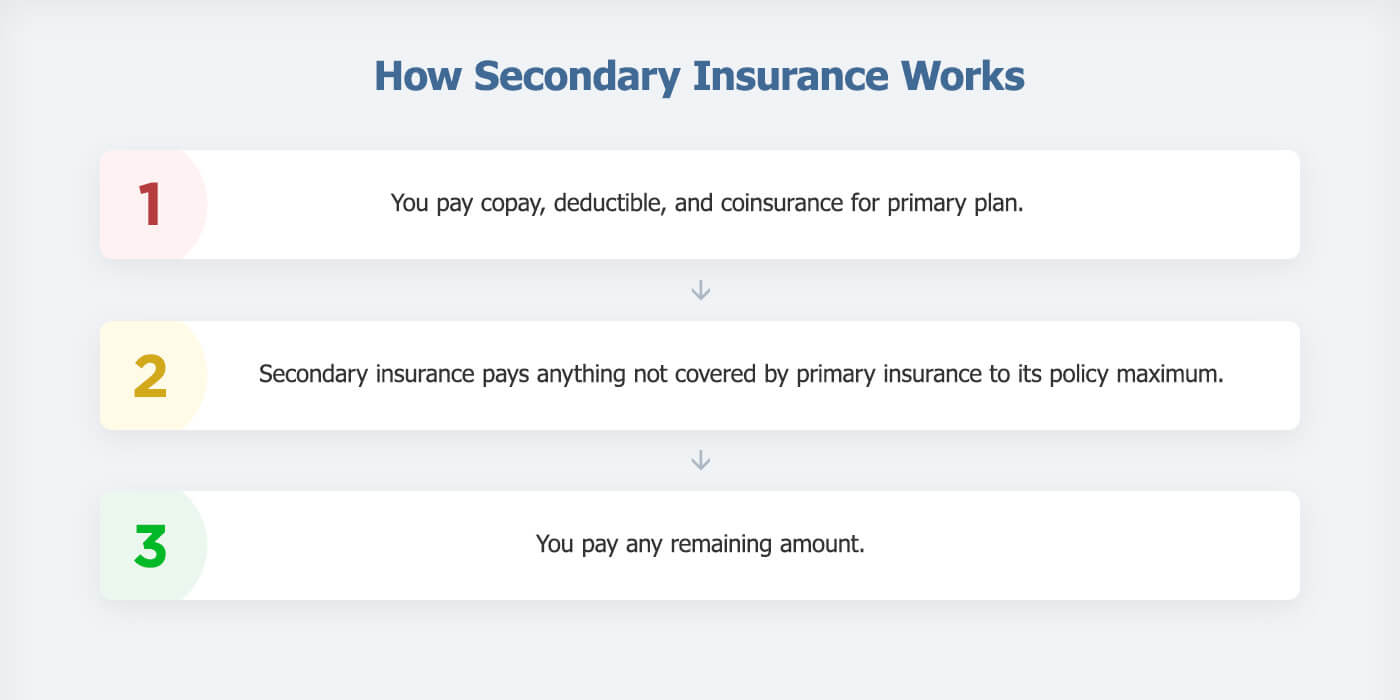

How Does Secondary Insurance Work?

In situations where both health insurances can provide coverage, the secondary insurance can help fill the gaps not covered by the primary coverage. In the case of travel insurance as your secondary insurance, you would simply pay the premium up front, and then the plan would pay secondary to your major medical insurance per its terms and conditions.

Let’s use the same example as above, but in this case you had the same procedure while on a domestic trip you have purchased travel insurance for:

What happens if secondary insurance pays more than primary?

In the case of travel insurance plans, secondary insurance rarely pays more than primary insurance due to the nature of the plans’ comparatively low premiums for travel insurance. If it does occur, it’s typically because the secondary insurance processed the claim as if there was no primary insurance, resulting in overpayment to the provider. In this case, the insurance companies and provider will correct the error, and you will not be responsible for additional payment.

Is there a downside to having secondary insurance?

The only downside to having secondary insurance is that you will be paying two premiums, and it’s no guarantee that both of them combined will pay 100% of your costs for every claim. They will each process claims according to their policy terms and conditions. Also, there will never be a case where multiple insurance plans pay more than 100% of your costs, so you should not expect extra cash payment to go to you.

How do you determine which insurance is primary and which is secondary?

Which insurance is primary and which is secondary is determined by the situation. If you get injured or sick at home, your major medical insurance will almost always be primary. However, if you are a passenger in a car accident, the driver's car insurance plan could become primary and your major medical insurance would be secondary. And if you are traveling abroad outside of their coverage area, your travel insurance would be your only medical insurance, and therefore become primary. The primary vs. secondary insurance rules can vary depending upon the particular situation, so don’t hesitate to contact the insurance administrator for more information.

Can't find answers to your questions?

Ask our specialists - Licensed and experienced insurance professionals in the U.S.